This was a big month in California. While the election may be the first thing that comes to mind, we also witnessed the first auction of carbon credits to companies that emit more than 25,000 tonnes of carbon dioxide every year. This newly regulated market is a key part of California’s cap-and-trade program which aims to reduce our state’s greenhouse gas emissions to 1990 levels by 2020. Only 8% of a company’s carbon emission reduction can be achieved through the purchase of carbon credits. In essence, this is a ‘trade’ made possible because additional carbon is being sequestered elsewhere in California to balance these emissions.

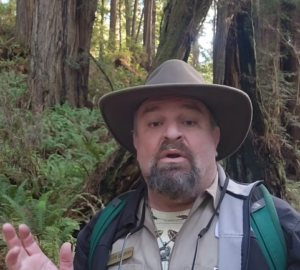

Here at the League we are keenly interested in what happens with the carbon market because it has the potential to impact redwood conservation. Forest owners now have a financial incentive to either plant native trees in areas previously deforested or to change the way that they harvest their trees so that the total amount of carbon dioxide stored in the forest as wood increases. Because of how fast redwoods grow and how long they live, taking carbon dioxide out of the atmosphere is something redwoods do better than just about any other tree. Their ability to sequester and store carbon makes redwood forests a very appealing option for carbon projects that produce credits for sale in the marketplace.

The first regulated sale of carbon yielded a low price, only $10.09 per tonne, but if the price climbs we might see more redwood landowners consider using their forests to sell carbon credits. Is the management of redwood lands for carbon storage good for redwood forests? This is the million-dollar question! In heavily harvested forests, letting the trees grow bigger helps create more habitat for wildlife. If revenue exchanged through the cap-and-trade program promotes this type of forest restoration, this could be a big win for the redwoods.

I’ll be watching for impacts of the carbon credit market on the redwoods closely while the rest of the country watches California take this huge first step forward to reduce emissions.

Want to learn more about redwoods and climate? See our Redwoods and Climate Change Initiative!